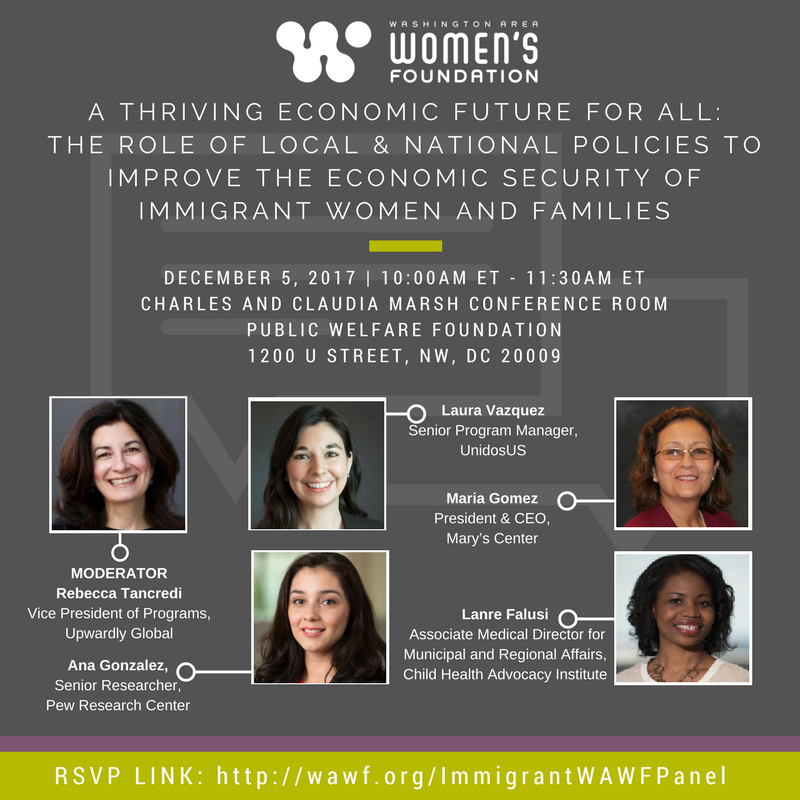

Panel: Economic Security of Immigrant Women and Families

Close to three-quarters of all immigrants in the U.S. are women and children. Policy rollbacks, cuts to funding, and threats to states that provide

Washington Area Women’s Foundation mobilizes our community to ensure that economically vulnerable women and girls of color in the Washington, D.C. region have the resources they need to thrive. Since 1998, The Women’s Foundation has worked to transform the lives of women and girls in our region and across the world.

© 2023 Washington Area Women’s Foundation

Washington Area Women’s Foundation mobilizes our community to ensure that economically vulnerable women and girls of color in the Washington, D.C. region have the resources they need to thrive. Since 1998, The Women’s Foundation has worked to transform the lives of women and girls in our region and across the world.

© 2023 Washington Area Women’s Foundation